Property Tax Notices

Property tax notices were mailed out in May 2024.

Due Dates

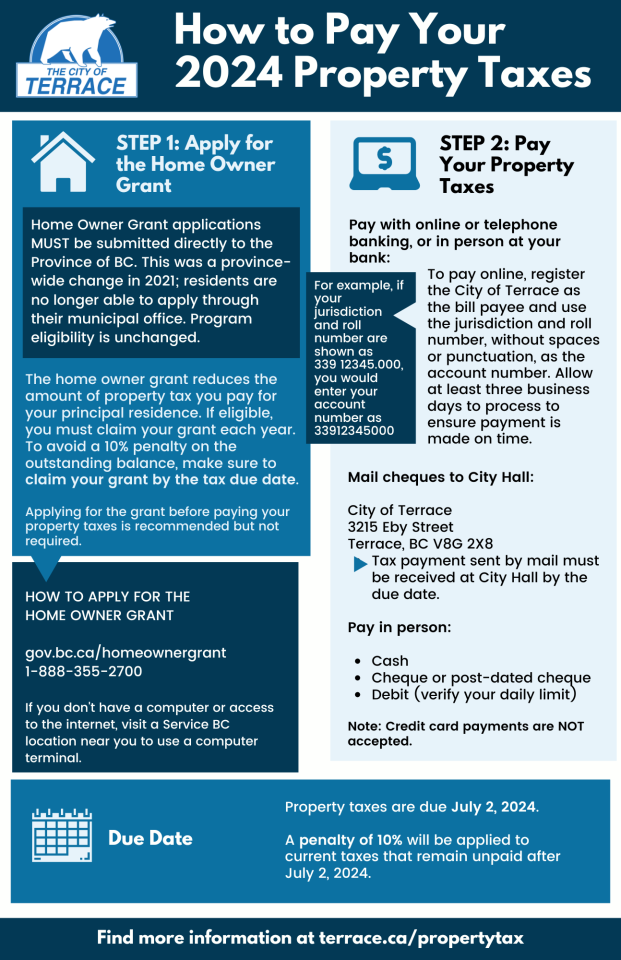

Property taxes are due July 2, 2024.

A penalty of 10% will be applied to current taxes that remain unpaid after July 2, 2024.

Home Owner Grant

All Home Owner Grant applications MUST be submitted directly to the BC government; this was a province-wide change in 2021. Residents in all municipalities no longer can apply through their municipal office. Please note that City of Terrace residents will still pay property taxes to the City as normal, but will not be able to claim their Home Owner Grant at City Hall.

The home owner grant reduces the amount of property tax you pay for your principal residence. If eligible, you must claim your grant each year. To avoid a 10% penalty on the outstanding balance, make sure to claim your grant by the tax due date (July 4).

HOW DO I APPLY?

Applying for the grant before paying your property taxes is recommended but not required. Home owners can apply for their current year (or a retroactive grant) through these channels:

- Online: gov.bc.ca/homeownergrant

- Toll-free by phone: 1-888-355-2700

If you don't have a computer or access to the internet, visit a Service BC location near you to use a computer terminal.

Most property owners qualify for the grant and will pay the reduced amount—no need to pay the full amount and then get reimbursed. The best time to apply is after property tax notices are mailed out in May but before the tax deadline of July 2.

Tips:

- You do not have to claim your grant before paying your property taxes, but it is recommended.

- If you have recently (within the last 24 hours or so) claimed your home owner grant, it will not yet show up in our system as being claimed. However, we will still be able to accept your payment for the reduced amount as if the grant had been processed.

- If you claimed your home owner grant prior to receiving your tax notice, the grant will show up as a negative adjustment under all three columns on your notice. Please pay the total amount due in the column applicable to you (A, B, or C).

LEARN MORE:

Please follow the link below or call 1-888-355-2700 (toll-free) to speak with an agent.

Learn more and apply here

How to Pay Your Property Taxes Remotely

Once you have claimed your Home Owner Grant (see above), please pay your property taxes via one of the methods below. If possible, please pay remotely by:

- Online banking

- To pay online, register the City of Terrace as a bill payee with your financial institution and use the "Jurisdiction" (339) and “Roll Number” on the top right-hand corner of your property tax notice as the account number. For example, if your jurisdiction and roll number are listed as 339 12345.000, you would enter your account number as 33912345000

- Telephone banking

- Mail

- City of Terrace

3215 Eby St

Terrace, BC

V8G 2X8

- City of Terrace

Please note payments MUST BE RECEIVED by the due date to avoid late penalties. Allow at least three business days to process to ensure payment is made on time.

How to Pay Your Property Taxes in Person

You may also pay in person by:

- Cash

- Cheque

- Post-dated cheque

- Debit (please verify your daily limit)

> Please note that credit card payments are NOT accepted.

City Hall is open:

Tax season hours - June 24 to July 2:

Monday to Friday

8:30 am–4:30 pm

Regular hours:

Monday to Friday

9:00 am to 4:00 pm (in person)

8:30 am–4:30 pm (by phone)

Provincial Property Tax Deferment Program

The Property Tax Deferment Program is a low-interest loan program, administered by the Province of BC, which assists qualified BC home owners to pay the annual property taxes on their principal residence.

Two programs available:

- Regular Program: For those who are age 55+ during the current year, or a surviving spouse of any ages, or a person with disabilities.

- Families with Children Program: For those who are a parent, step-parent, or are financially supporting a child.

All applications (new or renewal) can be submitted online after the payment of the previous year's taxes, utilities, penalties, and interest (if applicable). Apply before July 2 to avoid late fees, and be sure to claim the home owner grant as well to avoid a 10% penalty.

Please apply online through the province. Municipalities cannot accept applications for this program.

To apply, visit https://gov.bc.ca/propertytaxdeferment.

More information is also available by calling 1-888-355-2700 or emailing TaxDeferment@gov.bc.ca.

Additional Resources and Assistance

Please feel free to contact City Hall with any questions about property taxes:

- Email: cashier@terrace.ca

- 250-635-6311 during regular business hours

Return to the main Finance page for forms for pre-authorized payments, permissive tax exemptions, the tax deferment program, and more.